CoinLedger is a highly-rated crypto tax and portfolio tracking platform used by over 400,000 investors worldwide. It offers easy-to-use features, integrations with hundreds of exchanges and blockchains, and support for DeFi, NFTs, and tax-loss harvesting. CoinLedger’s pricing is designed to be affordable, making it a top choice for individuals looking for an economical crypto tracking solution.

The Best Crypto Tax Software Platforms

When it comes to choosing the best crypto tax software platforms, there are several top contenders in the market. Alongside CoinLedger, other popular options include ZenLedger, Koinly, TokenTax, CoinTracker, TaxBit, and Bitcoin.Tax. These platforms offer a range of features to help individuals track and report their cryptocurrency transactions for tax purposes.

While each platform has its strengths, CoinLedger stands out for its user-friendly interface, extensive exchange and blockchain support, tax-loss harvesting capabilities, and excellent customer support. With CoinLedger, users can easily navigate the platform and input their transaction data, ensuring accurate tax reporting.

Moreover, CoinLedger integrates seamlessly with popular tax software like TurboTax, making the overall tax filing process more streamlined. The platform also offers support for complex crypto activities such as DeFi and NFTs, ensuring that users can track and report these transactions for tax purposes effectively.

Comparison of Features in Top Crypto Tax Software Platforms

| Platform | User-Friendly Interface | Exchange and Blockchain Support | Tax-Loss Harvesting | Customer Support | DeFi and NFT Support | Integration with TurboTax |

|---|---|---|---|---|---|---|

| CoinLedger | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ZenLedger | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Koinly | ✓ | ✓ | ✓ | ✓ | ✓ | |

| TokenTax | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| CoinTracker | ✓ | ✓ | ✓ | ✓ | ||

| TaxBit | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Bitcoin.Tax | ✓ | ✓ | ✓ | ✓ |

As shown in the table above, CoinLedger excels in providing a comprehensive set of features that cater to the needs of cryptocurrency investors. Its combination of user-friendly interface, extensive exchange and blockchain support, tax-loss harvesting capabilities, and excellent customer support make it one of the best crypto tax software platforms available.

CoinLedger Features and Benefits

CoinLedger offers a range of features and benefits that make it a top choice for individuals seeking a reliable and efficient crypto tracking solution. Whether you’re a beginner or an experienced investor, CoinLedger has you covered with its user-friendly interface and comprehensive functionality. Let’s explore some of the key features and benefits:

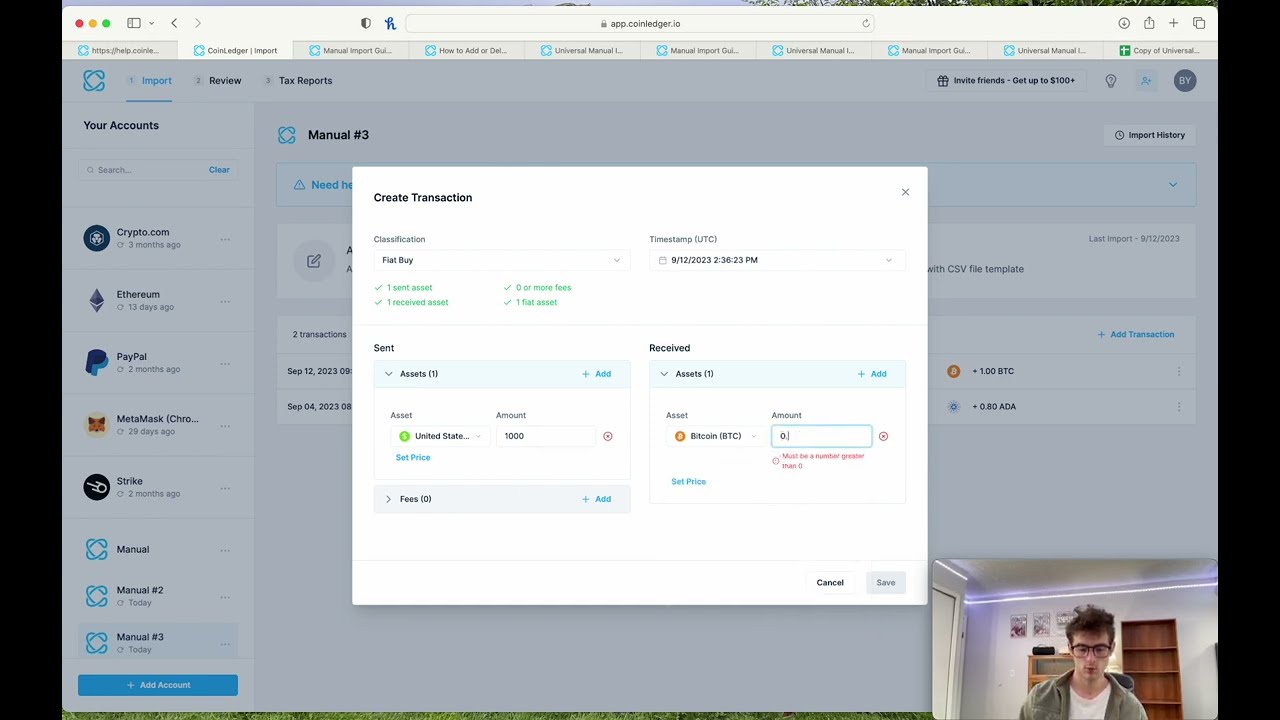

1. Easy Importing of Wallets and Transactions

CoinLedger allows you to import your wallets and transactions within minutes, making the process of reporting taxes a breeze. With just a few simple steps, you can sync your crypto assets and transactions from various sources, eliminating the need for manual data entry and ensuring accurate tax reporting.

2. Support for DeFi and NFTs

As the crypto market evolves, CoinLedger stays up-to-date with the latest trends. It offers support for decentralized finance (DeFi) platforms and non-fungible tokens (NFTs), allowing you to track your investments in these emerging areas. Whether you’re participating in liquidity mining or collecting digital art, CoinLedger has the capabilities to handle your diverse crypto portfolio.

3. Extensive Exchange and Blockchain Support

CoinLedger integrates with hundreds of exchanges and blockchains, ensuring that you can easily import your transaction data from your preferred platforms. Whether you trade on popular exchanges like Binance, Coinbase, or Kraken, or you engage with different blockchains such as Ethereum or Polkadot, CoinLedger has the necessary connections to streamline your tax reporting process.

4. Tax-Loss Harvesting Reports

CoinLedger goes beyond basic tax reporting by providing tax-loss harvesting reports. This feature helps you optimize your tax liability by identifying opportunities to offset capital gains with capital losses. By leveraging CoinLedger’s tax-loss harvesting capabilities, you can potentially reduce your overall tax burden and maximize your crypto investment returns.

| Features | Benefits |

|---|---|

| Easy importing of wallets and transactions | Efficient and accurate tax reporting |

| Support for DeFi and NFTs | Comprehensive tracking of diverse crypto investments |

| Extensive exchange and blockchain support | Seamless integration with your preferred platforms |

| Tax-loss harvesting reports | Opportunities to minimize tax liability and maximize returns |

In addition to these features, CoinLedger offers customer support via email and live chat, data reconciliation features, and the option to have an expert review your tax return. With its international reach, customers from countries like the United States, Canada, Australia, and Japan can benefit from CoinLedger’s services.

Overall, CoinLedger provides a robust and affordable solution for individuals looking to effectively manage their crypto portfolios and stay compliant with tax regulations. Its user-friendly interface, extensive features, and reliable customer support make it a top contender in the crypto tax software market.

User Testimonials for CoinLedger

Users of CoinLedger have been highly satisfied with their experience and have praised the platform for its intuitive user interface, ease of use, and outstanding customer service. Here are some testimonials from actual CoinLedger users:

Testimonial 1:

“I’ve been using CoinLedger for over a year now, and I couldn’t be happier with the platform. It’s incredibly user-friendly, and I was able to import all my transactions and generate a comprehensive tax report in no time. The customer support team has been exceptionally helpful and responsive whenever I had questions or needed assistance. Thanks to CoinLedger, tax season has become much less stressful for me.”

Testimonial 2:

“CoinLedger is hands down the best crypto tax software I’ve ever used. The platform is lightning-fast, and importing my transactions from different wallets and exchanges was a breeze. I also love the fact that CoinLedger supports DeFi and NFTs, as I have holdings in those areas. The tax-loss harvesting reports have been incredibly helpful in optimizing my tax strategy. Overall, I highly recommend CoinLedger to anyone looking for a reliable and user-friendly solution for their crypto tax needs.”

Testimonial 3:

“I’ve tried a few different crypto tax software platforms, but CoinLedger is by far the best. The interface is so intuitive that even someone with limited technical knowledge like me can easily navigate and use all its features. The platform’s performance is impressive, and it never lags or freezes. Whenever I needed help, the customer support team was there to assist me promptly. CoinLedger has made tax reporting a stress-free task for me, and I can’t thank them enough.”

| Feature | Positive | Negative |

|---|---|---|

| User-Friendly Interface | Intuitive design | N/A |

| Importing Transactions | Efficient and quick | N/A |

| Support for DeFi and NFTs | Allows tracking of all crypto assets | N/A |

| Tax-Loss Harvesting Reports | Helps optimize tax strategy | N/A |

| Customer Support | Responsive and helpful | N/A |

How Crypto Tax Software Works

Crypto tax software simplifies the process of tracking and reporting cryptocurrency transactions for tax purposes. By connecting your wallets and exchanges to the software, you can import your transactions and generate a comprehensive tax report. This automated approach saves time and effort compared to manually tracking transactions and ensures accuracy in reporting capital gains, losses, and income.

When you use crypto tax software, you begin by connecting your various wallets and exchanges to the platform. This allows the software to fetch your transaction data automatically, eliminating the need for manual entry. The software then organizes and categorizes your transactions, making it easier to calculate your tax liabilities.

Once your transactions are imported, the software applies the relevant tax rules and regulations to calculate your capital gains, losses, and income. It takes into account factors such as the holding period, cost basis, and fair market value of your cryptocurrencies. The software also considers any tax deductions or credits you may be eligible for, such as tax-loss harvesting or specific exemptions.

| Step | Description |

|---|---|

| Connect Wallets and Exchanges | Link your wallets and exchanges to the software, allowing it to automatically import your transaction data. |

| Organize and Categorize Transactions | The software organizes your transactions into categories, making it easier to calculate your tax liabilities. |

| Apply Tax Rules and Regulations | The software applies the relevant tax rules and regulations to calculate your capital gains, losses, and income. |

| Generate Tax Reports | Once the calculations are complete, the software generates comprehensive tax reports that can be used for filing purposes. |

Crypto tax software streamlines the tax reporting process, saving you time and ensuring accuracy. It eliminates the need for manual calculations and reduces the risk of errors. With the help of crypto tax software, you can confidently report your cryptocurrency transactions and meet your tax obligations.

Important Features to Consider When Choosing Crypto Tax Software

When selecting crypto tax software, it is crucial to consider various important features that can enhance your experience and ensure seamless tax reporting. Here are some key factors to keep in mind:

User-Friendly Interface:

Opt for software with an intuitive and user-friendly interface. This will make the tax season less stressful and enable you to navigate through the platform effortlessly.

Automatic Import Capabilities:

Choose a software that offers automatic import capabilities, allowing you to fetch transactions directly from your wallets and exchanges. This automation saves time and ensures accurate reporting of capital gains, losses, and income.

Customer Support:

Ensure the software provider offers excellent customer support. Whether you have inquiries or encounter issues during the tax reporting process, having responsive and knowledgeable support can make a significant difference.

Integration with Tax Software:

Look for software that integrates smoothly with popular tax software like TurboTax. This compatibility streamlines your overall tax filing process, enabling you to seamlessly import your crypto tax data into your tax return.

| Important Features | Benefits |

|---|---|

| User-Friendly Interface | Eases the tax reporting process |

| Automatic Import Capabilities | Saves time and ensures accuracy |

| Customer Support | Assistance in addressing inquiries and issues |

| Integration with Tax Software | Seamless integration with overall tax filing process |

By considering these essential features, you can make an informed decision when choosing the right crypto tax software for your needs. Remember, finding a platform that offers a user-friendly experience, automatic import capabilities, reliable customer support, and integration with popular tax software will contribute to a smoother and more efficient tax reporting process.

Get Started with CoinLedger

To start using CoinLedger, you can create a free account on their platform. The initial setup is quick and easy, and you don’t need to provide any credit card details. Once you’ve set up your account, you can begin importing your transactions and exploring the various features offered by CoinLedger.

With CoinLedger, you have the flexibility to import your wallets and transactions in just a few minutes. This streamlined process ensures that reporting your taxes becomes a hassle-free experience. Whether you’re an individual investor or a seasoned trader, CoinLedger provides the tools you need to track, manage, and optimize your crypto portfolio.

When it’s time to file your taxes, you can download your comprehensive tax report from CoinLedger. This report contains all the necessary information required for accurate tax reporting, including capital gains, losses, and income. You can then use this report in conjunction with your preferred tax software or consult with a tax professional to ensure a seamless and compliant tax filing process.

Table: CoinLedger Account Features

| Features | Description |

|---|---|

| Free Account | Create a free account with no credit card required. |

| Wallet and Transaction Import | Easily import your wallets and transactions for accurate tax reporting. |

| Comprehensive Reporting | Generate detailed tax reports including capital gains, losses, and income. |

| DeFi and NFT Support | Track and manage your decentralized finance (DeFi) and non-fungible token (NFT) investments. |

| Tax-Loss Harvesting | Maximize your tax savings by utilizing tax-loss harvesting strategies. |

| Customer Support | Access dedicated customer support via email and live chat for any assistance you may need. |

Conclusion

In conclusion, CoinLedger is the top choice for individuals seeking an affordable and efficient crypto tax software solution. With its user-friendly interface, extensive exchange and blockchain support, and comprehensive tax reporting capabilities, CoinLedger simplifies the process of tracking and reporting cryptocurrency transactions.

By utilizing CoinLedger’s features, such as easy importing of wallets and transactions, support for DeFi and NFTs, and tax-loss harvesting reports, users can save time and ensure accuracy in their tax filings. The platform also provides excellent customer support via email and live chat, making the entire experience stress-free and seamless.

Whether you’re a seasoned crypto investor or new to the world of cryptocurrencies, CoinLedger offers a cost-effective solution that meets all your needs. With its global reach and compatibility with popular tax software like TurboTax, CoinLedger is the trusted partner for individuals worldwide looking to streamline their crypto tax reporting.

FAQ

What is CoinLedger?

CoinLedger is a crypto tax and portfolio tracking platform used by over 400,000 investors worldwide.

What features does CoinLedger offer?

CoinLedger offers easy-to-use features, integrations with hundreds of exchanges and blockchains, support for DeFi and NFTs, and tax-loss harvesting.

How does CoinLedger compare to other crypto tax software platforms?

CoinLedger stands out for its user-friendly interface, extensive exchange and blockchain support, tax-loss harvesting capabilities, and excellent customer support.

What are the benefits of using CoinLedger?

CoinLedger supports importing wallets and transactions in minutes, offers support for DeFi and NFTs, provides tax-loss harvesting reports, and offers excellent customer support.

What do users say about CoinLedger?

Users praise CoinLedger for its intuitive UI, ease of use, fast app performance, and excellent customer service.

How does crypto tax software work?

Crypto tax software simplifies the process of tracking and reporting cryptocurrency transactions for tax purposes by automating the import and generation of tax reports.

What features should I consider when choosing crypto tax software?

Important features to consider include ease of use, automatic import capabilities, customer support, and compatibility with popular tax software.